Analysis

of the leasing

market

Leasing is an effective tool for renewing fixed assets and is actively used in world practice. In Kazakhstan, leasing activities are regulated by the Law of the Republic of Kazakhstan dated July 5, 2000 No. 78-II On Financial Leasing, the Civil Code of the Republic of Kazakhstan (Special Part) and the Code of the Republic of Kazakhstan On Taxes and Other Mandatory Payments to the Budget (Tax Code).

According to the Bureau of National Statistics of the Agency for Strategic Planning and Reforms of the Republic of Kazakhstan (hereinafter referred to as the Bureau of Statistics), in 2024 in the country:

- the current leasing portfolio amounted to 2,518.9 billion KZT, and compared to 2023, the increase was 712.3 billion KZT;

- the cost of financial leasing agreements – 991.3 billion KZT, the increase compared to 2023 was 234.6 billion KZT.

The most attractive sectors were transport and warehousing – 36%, agriculture, forestry and fisheries – 27.3%, and manufacturing – 21.6% of the total value of financial leasing agreements.

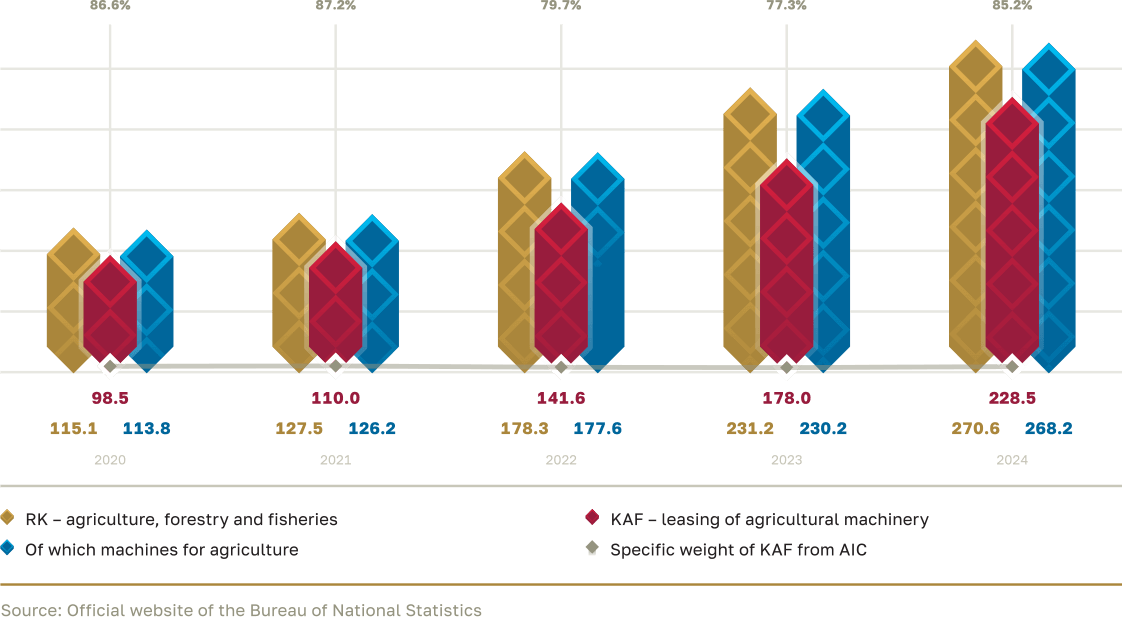

Number (units) and value of agreements (billion KZT) by areas of financial leasing use, including in the agro-industrial complex:

| Vehicles and equipment | Other machines and equipment | of which machines for agriculture and forestry | Total | |||||

| bln KZT | units | bln KZT | units | bln KZT | units | bln KZT | units | |

| Republic of Kazakhstan | 506 | 3,477 | 486 | 11,461 | 268 | 11,023 | 991.3 | 14,938 |

| Agriculture, forestry and fisheries | 2 | 30 | 269 | 11,062 | 268 | 11,022 | 270.6 | 11,092 |

Source: Official website of the Bureau of National Statistics

The company is the main lessor in the agricultural sector.

In 2024, a large-scale preferential leasing program was launched for the amount of 120 billion KZT with an interest rate of 5% per annum and a term of 7 years.

In 2024, the Company leased 10,543 units of equipment for the amount of 228.5 billion KZT, where the share is:

- 85.21% of the total value of contracts for leasing machinery for agriculture and forestry in Kazakhstan;

- 84.46% of the total value of contracts in the agriculture, forestry and fisheries sector.

Share of the cost of financial leasing agreements of the Company

| 2023 | 2024 | |

| share of the total value of contracts in the country | 23.52% | 23.05% |

| share of the value of contracts in the agro-industrial complex | 76.99% | 84.46% |

| including from the cost of contracts for agricultural machinery | 77.33% | 85.21% |

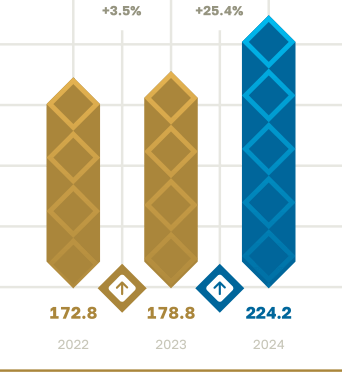

Dynamics of contract value, billion KZT

Thus, for the period of activity from January 1, 2000 to December 31, 2024, the acquisition of more than 87 thousand units of agricultural machinery and equipment was financed for a total of 1,433.2 billion KZT.

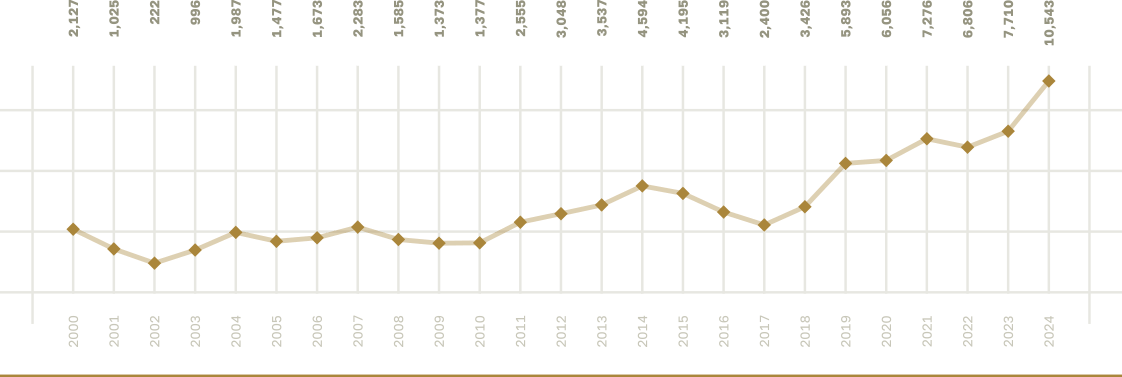

Dynamics of leasing in the period 2000-2024, units

Government programs to support the economy, primarily in the agricultural sector, industry, and small and medium-sized businesses, continue to have a significant impact on the leasing industry, since government support is often provided through leasing financing.

Currently, KazAgroFinance remains the undisputed leader in the agricultural leasing market. The Company’s programs are preferable for farmers due to the seasonal schedule of principal repayment (payment once a year after harvest), long leasing terms, no fees, as well as a low advance payment and a fairly large amount of experience in this area. Moreover, the key advantages of leasing financing by the Company for farmers are:

- more flexible terms and schemes for lease financing. When leasing, no additional collateral is required, since the leasing object itself serves as security;

- the availability of programs for subsidising interest rates and subsidising investment in machinery and equipment through the Ministry of Agriculture of the Republic of Kazakhstan;

- wide regional coverage (15 branches), which no other leasing company in Kazakhstan can provide.

Official statistics show that financial leasing is not used to its full extent in the country, including in the agricultural sector.

Underfunding of the agro-industrial complex affects food security, where farmers do not update equipment and machinery in a timely manner, which reduces productivity and leads to shortages, and, accordingly, to higher prices.

In its activities, the company is guided by the main directions of state policy in the field of development of the agro-industrial complex, as well as the tasks set by the President and the Government of the Republic of Kazakhstan.

Today, 13 leasing companies are engaged in leasing agricultural machinery and equipment.

Thanks to the widespread use of government support instruments, the leasing market in Kazakhstan is showing steady growth. Companies with special programs for leasing agricultural machinery and equipment offer the following financing terms:

| Name | Asset Financing | Conditions | ||

| Lease term | Interest rate | Initial instalment | ||

| Forteleasing JSC | Equipment, transport, special machinery. | From 12 to 84 months (depending on the country of manufacture) | Base rate + 6 percentage points | from 20% |

| Leasing Group JSC | Specialised machinery, equipment | 37-60 months | from the Base rate set by the National Bank of the Republic of Kazakhstan + 5% and higher Possibility of subsidising the interest rate under the damu.kz program | from 20% |

| Subsuduary of Nurbank JSC Leasing company Nur leasing LLP | Specialised machinery, equipment | from 37 months | from 19.25% per annum; When subsidising EDF DAMU JSC – from 8% per annum | from 20% |

| Private company MERZ Leasing LTD | Agricultural machi-nery, including mounted and trailed equipment | up to 60 months | from 6% | from 20% |

| LLP Techno Leasing | Agricultural machinery | 3-5 years | 22.75% per annum; 6% taking into account subsidising | from 20% |

| QZQ FINANCE LLP | Agricultural machinery; special equipment | from 37 to 84 months | from 14% | from 15% |

| Industrial Development Fund JSC | Agricultural machinery | up to 7 years | 7% at the expense of budgetary funds, 15% at the expense of commercial funds | from 15% |

| Kazakhstan Ijara Company JSC | Agricultural machinery | from 12 months and above | individually | from 20% |

| GARANTI LEASING LLP | Agricultural machinery; equipment | from 37 months | from 6% (subsidising under the Ministry of Agriculture program) | from 20% |

| Subsidiary of Halyk Bank of Kazakhstan Halyk-Leasing JSC | Agricultural machinery | from 37 months to 60 months | Base rate of the National Bank of the Republic of Kazakhstan +5% (taking into account the subsidy of DAMU 7%/ 8%) | from 20% |

| NKB LEASING LLP | Special equipment | from 37 months | from 14% | from 20% |

| Partner leasing LLP | Special equipment, equipment | from 12 months to 60 months | No more than 16% per annum (DAMU) | from 15% |

| KazAgroFinance JSC | Agricultural machinery; equipment | Company products of the KazAgroFinance JSC | ||

Operating

results

15,786 clients

financed

in 2024

1,634.0 billion KZT

invested in the AIC

from 2000 to 2024

Results

of activities

2023 | 2024 | Dynamics |

| | | |

| Volume of financing | ||

| 178.8 bln KZT | 224.2 bln KZT | 25.4% |

| | | |

| Number of equipment | ||

| 7,710 units | 10,543 units | 36.7% |

| | | |

| Including KZ equipment | ||

| 4,142 units | 7,802 units | 88.4% |

| | | |

| Loan portfolio | ||

| 477.9 bln KZT | 609.1 bln KZT | 27.4% |

| | | |

| NPL 90+ | ||

| 8.13% | 7.15% | 12.1% |

| | | |

| Provisions | ||

| 10.85% | 12.27% | 13.1% |

| | | |

| Number of clients | ||

| 13,234 agricultral producers | 15,786 agricultral producers | 19.3% |

| | | |

Investment volume, billion KZT

From 2009 to 2016, KazAgroFinance acted as an operator for financing investment projects, including those implemented using funds from the National Fund of the Republic of Kazakhstan. Since 2017, the Company has been concentrating its activities exclusively on agricultural technology lease.

For the period from 2000 to 2024, the Company invested approximately 1,634.0 billion KZT in the agro-industrial complex, including equipment leasing and loans for previously financed investment projects.

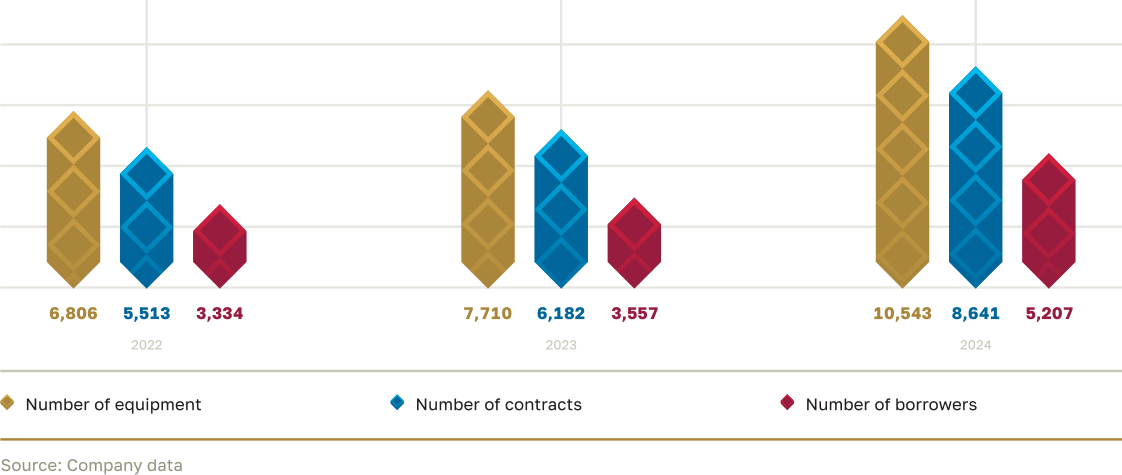

Dynamics of quantitative indicators of the Company, units

| Name of equipment | 2022 | 2023 | 2024 | Total for 2022–2024 | ||||

| quantity | amount, mln KZT | quantity | amount, mln KZT | quantity | amount, mln KZT | quantity | amount, mln KZT | |

| Seeding complexes | 190 | 8,547 | 191 | 8,016 | 135 | 10,154 | 2,303 | 95,030 |

| Tractors | 2,896 | 65,308 | 2,846 | 63,690 | 4,729 | 87,654 | 29,326 | 419,821 |

| Harvesters | 507 | 57,375 | 512 | 55,945 | 924 | 88,257 | 13,954 | 532,378 |

| Seeders | 284 | 9,339 | 172 | 6,478 | 273 | 5,504 | 3,928 | 52,129 |

| Other equipment | 2,929 | 32,267 | 3,989 | 43,858 | 4,482 | 36,977 | 37,168 | 274,976 |

| Equipment | 604 | 58,897 | ||||||

| Total | 6,806 | 172,836 | 7,710 | 177,989 | 10,543 | 228,546 | 87,283 | 1,433,231 |

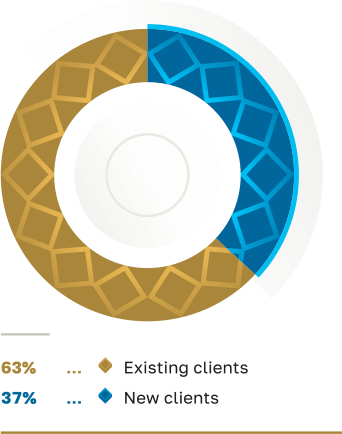

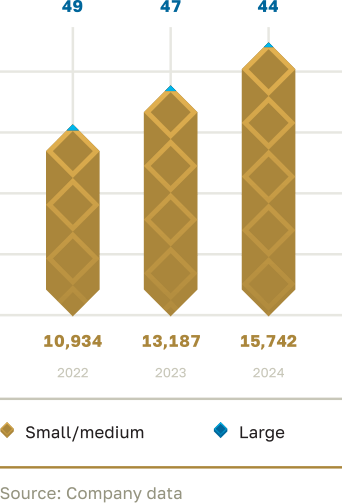

Number of clients

by business size, units

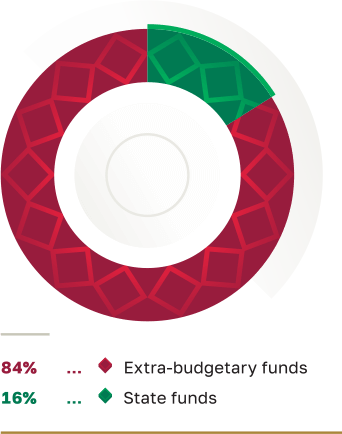

The most popular programs in 2024 were Preferential Leasing and Leasing on Market Terms.

The main advantage of the Preferential Leasing program is the preferential interest rate – 5% per annum. The lessee is allowed to pay the first lease payment (at least 10% of the value of the leased item) after the transfer of the leased item no later than December 1, 2025. The maximum financing period is no more than 7 years.

The advantages of the Leasing on Market Terms program include a large selection of agricultural machinery and suppliers. The program also provides for a long term (up to 10 years) of financing and a deferment of 15% of the value of the leased item until November 10 of the year in which the financing is received.

Leasing structure under Financing Programs

| Program | Number of contracts | Number of equipment, units | Cost of equipment, million KZT |

| Leasing on market terms | 2,683 | 3,450 | 66,999 |

| Preferential leasing (5%) | 3,546 | 4,320 | 120,061 |

| Preferential leasing (6%) | 257 | 290 | 16,762 |

| Made in Kazakhstan | 277 | 336 | 10,518 |

| Zhasyl-Onim | 161 | 176 | 2,756 |

| Our Own Feed | 1,717 | 1,971 | 11,450 |

| Total | 8,641 | 10,543 | 228,546 |

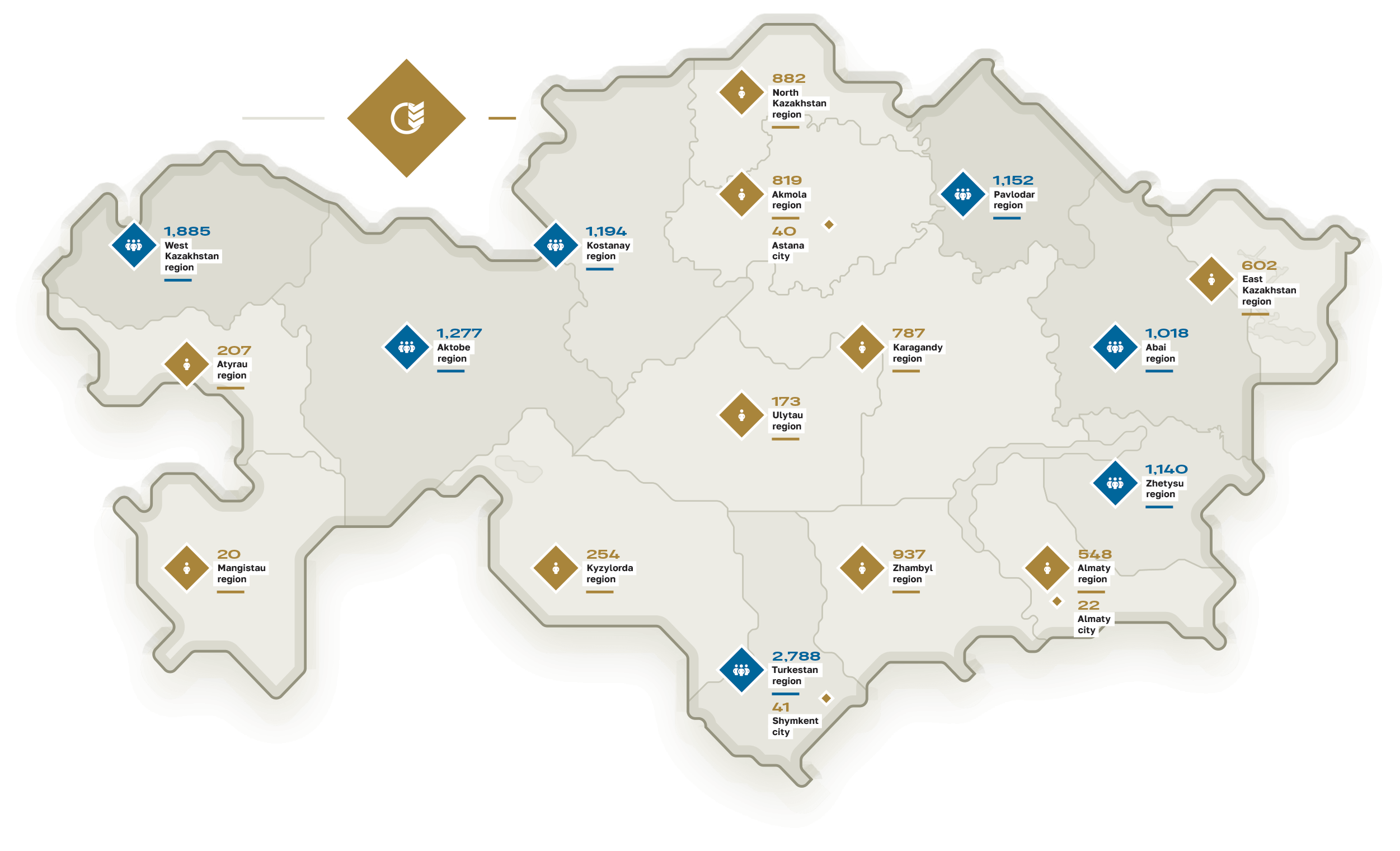

Client structure

in the portfolio

by region in 2024

In the regional map of the Company’s clients, Turkestan, West Kazakhstan, Aktobe, Kostanay, Pavlodar, Zhetysu and Abay regions have more than a thousand clients.

Financial

results

Key financial indicators

| million KZT | 2024 | 2023 |

| Assets | ||

| Cash and cash equivalents | 53,631 | 43,801 |

| Funds in credit institutions | 2,434 | - |

| Loans to customers | 7,557 | 8,111 |

| Accounts receivable under finance leases | 550,252 | 448,424 |

| Inventories | 2,985 | 3,043 |

| Property, plant and equipment | 862 | 872 |

| Other assets | 26,526 | 19,053 |

| Total assets | 644,247 | 523,303 |

| Liabilities | ||

| Debt to the Shareholder | 12,949 | 17,641 |

| Debt to NMH Baiterek JSC | 13,368 | 12,424 |

| Funds of credit institutions | 16,184 | 34,081 |

| Issued debt securities | 343,171 | 210,268 |

| Government subsidies | 50,355 | 43,518 |

| Other liabilities | 15,556 | 19,802 |

| Total liabilities | 451,583 | 337,734 |

| Equity | 192,664 | 185,569 |

| ROA | 3.49 | 3.79 |

| ROE | 10.76 | 11.05 |

| Book value of one common share (in KZT) | 1,869.98 | 1,800.48 |

| billion KZT | 2024 | 2023 | 2024 in % to 2023 |

| Income, total | 91.25 | 72.70 | 125.52% |

| including: | |||

| Income in the form of renumeration | 90.62 | 72.24 | 125.44% |

| Expenses, total | 72.63 | 53.77 | 135.08% |

| including: | |||

| Remuneration expenses | 40.45 | 34.50 | 117.25% |

| Expenses for creating reserves | 22.74 | 12.08 | 188.32% |

| CIT | - 1.72 | 0.0 | - |

| Net income | 20.3 | 18.9 | 107.49% |

KazAgroFinance continues to demonstrate positive financial indicators, reflecting successful operational activities in the agricultural sector, financial stability and consistent development of the Company.