Mission

Technical and technological modernisation of business entities of the agro-industrial complex of the Republic of Kazakhstan.

Vision

KazAgroFinance is a partner providing comprehensive support to clients in the agro-industrial complex using digital solutions.

Ratings

On September 18, the international rating agency Fitch Ratings confirmed the long-term ratings of KazAgroFinance in foreign and national currencies at the level of “BBB-”, the rating outlook is “Stable”.

Licenses

License of the Agency of the Republic of Kazakhstan for Regulation and Supervision of the Financial Market and Financial Organisations to conduct banking loan operations in national currency (received on March 31, 2006).

Certification

Certification according to the quality management system ISO 9001-2015.

Purpose in

the industry

Technological modernisation of the agro-industrial complex by providing agricultural producers with affordable financial resources for the acquisition of agricultural equipment on a leasing basis.

Types

of activities:

- leasing activities in the agro-industrial complex;

- lending and other types of activities not prohibited by legislation, consistent with the goals and objectives of the Company, as provided for by the Charter of KazAgroFinance;

- participation in the implementation of republican budget and other programs aimed at the development of the agro-industrial complex.

Geography

of activity

15 branches in all regions of the country. Cooperation with Kazakhstani factories – manufacturers of equipment, as well as suppliers from near and far abroad.

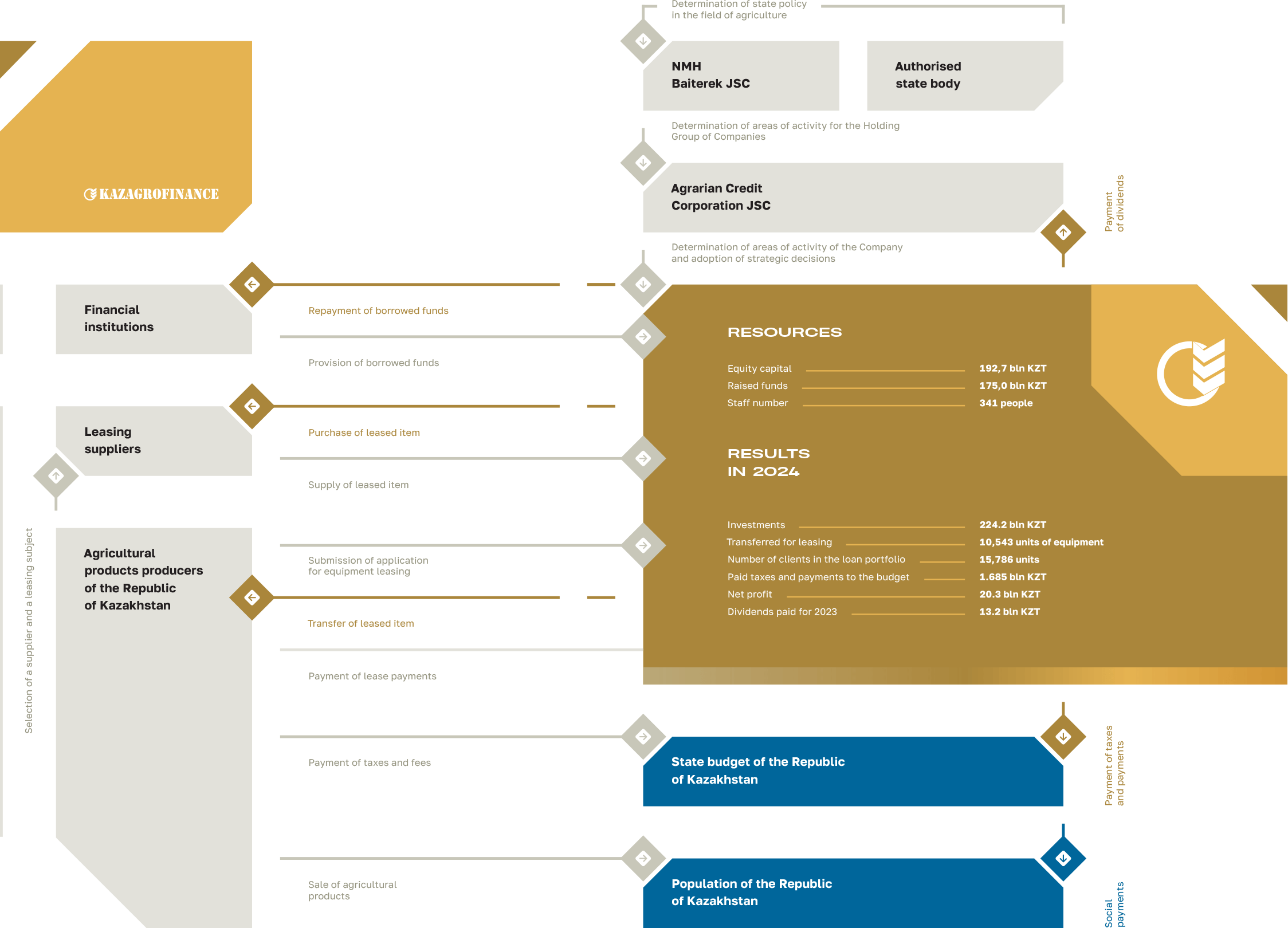

Business Model

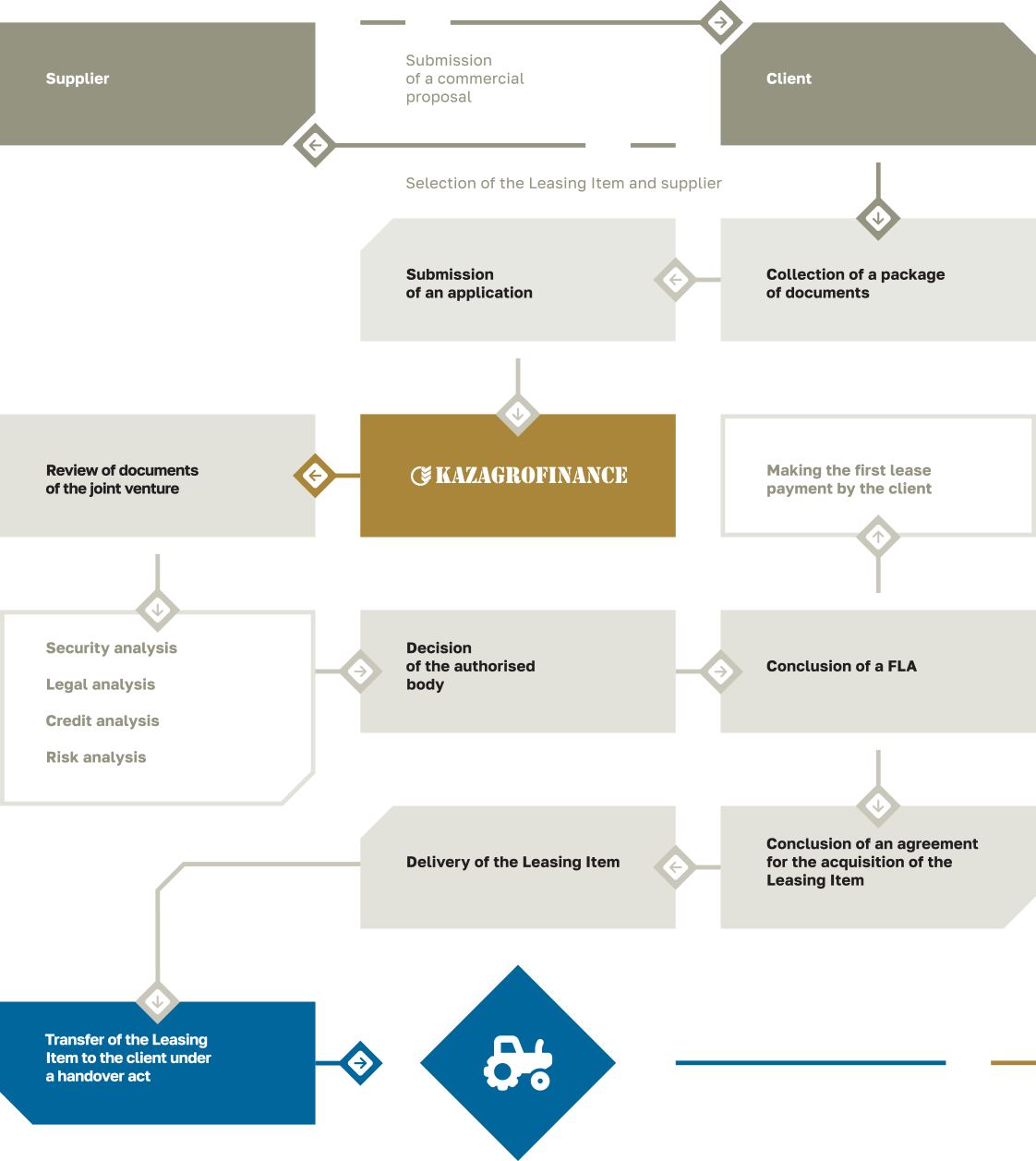

Leasing

process

Areas

of Activity

In 2024, the Company had the following programs:

Leasing

on market

terms:

- Agricultural machinery (self-propelled, mounted and trailed)

- Special equipment for melioration and agricultural work, including unmanned aerial vehicles

- Vehicles for the transportation of biological assets, agricultural and fish products, including freight cars

Preferential

Financing

Programs:

- Made in Kazakhstan

- Preferential leasing 5%

- Preferential leasing 6%

- Our own feed

Financing

programs at the end of 2024

| Term | Advance | Rate | |

| Leasing on market terms | |||

| Agricultural machinery (mounted, trailed, self-propelled agricultural machinery) | up to 10 years | from 0% | Base rate of the National Bank of the Republic of Kazakhstan plus 7.5% (including subsidies for priority types of equipment – 6%, for others – 15%) |

| Special equipment for melioration and agricultural work | up to 7 years | from 0% | Base rate of the National Bank of the Republic of Kazakhstan plus 7.5% (including subsidies for priority types of equipment – 6%, for others – 15%) |

| Vehicles (including tractors and trailers) for the transportation of agricultural and fish products and their processed products, biological assets | up to 7 years | from 0% | Base rate of the National Bank of the Republic of Kazakhstan plus 7.5% (including subsidies for priority types of equipment – 6%, for others – 15%) |

| Leasing of unmanned aerial systems for agricultural work Unmanned aerial systems (UAS) for agricultural work | up to 5 years | not less than 20% | Base rate of the National Bank of the Republic of Kazakhstan plus 7.5% (not subsidised) |

| Leasing of used agricultural machinery Used agricultural machinery | up to 7 years | not less than 15% | Base rate of the National Bank of the Republic of Kazakhstan plus 7.5% (not subsidised) |

| Conditions of preferential financing programs | |||

| Made in Kazakhstan Agricultural equipment and domestically produced/assembled vehicles | up to 10 years | not less than 15%* | 6% |

| Preferential leasing 5% Domestic production and/or assembly of agricultural machinery | up to 7 years | not less than 10%* | 5% |

| «Preferential leasing 6% Self-propelled agricultural machinery of domestic production/assembly | up to 10 years | from 0%* | 6% |

| Our own feed Agricultural equipment, forage harvesting equipment and mobile irrigation systems | up to 10 years | not less than 15%* | 6% |

* There is an opportunity to receive investment subsidies for the repayment of the principal debt, including for use as an advance payment for priority types of equipment

The preferential terms of financing in the form of leasing are the provision of equipment without collateral, without paying commissions with the provision of a grace period, long financing terms, without making an advance payment (due to investment subsidies in the amount of 15% of the cost of the equipment).

The remuneration rate is subsidised by the state, the final remuneration rate for the client is 6% per annum for priority types of equipment and 15% for other types.