The Company views corporate governance as a means of improving operational efficiency, ensuring transparency and accountability, strengthening its reputation and reducing its costs of raising capital.

The Company’s corporate governance is built on the principles of fairness, honesty, responsibility, transparency, professionalism and competence.

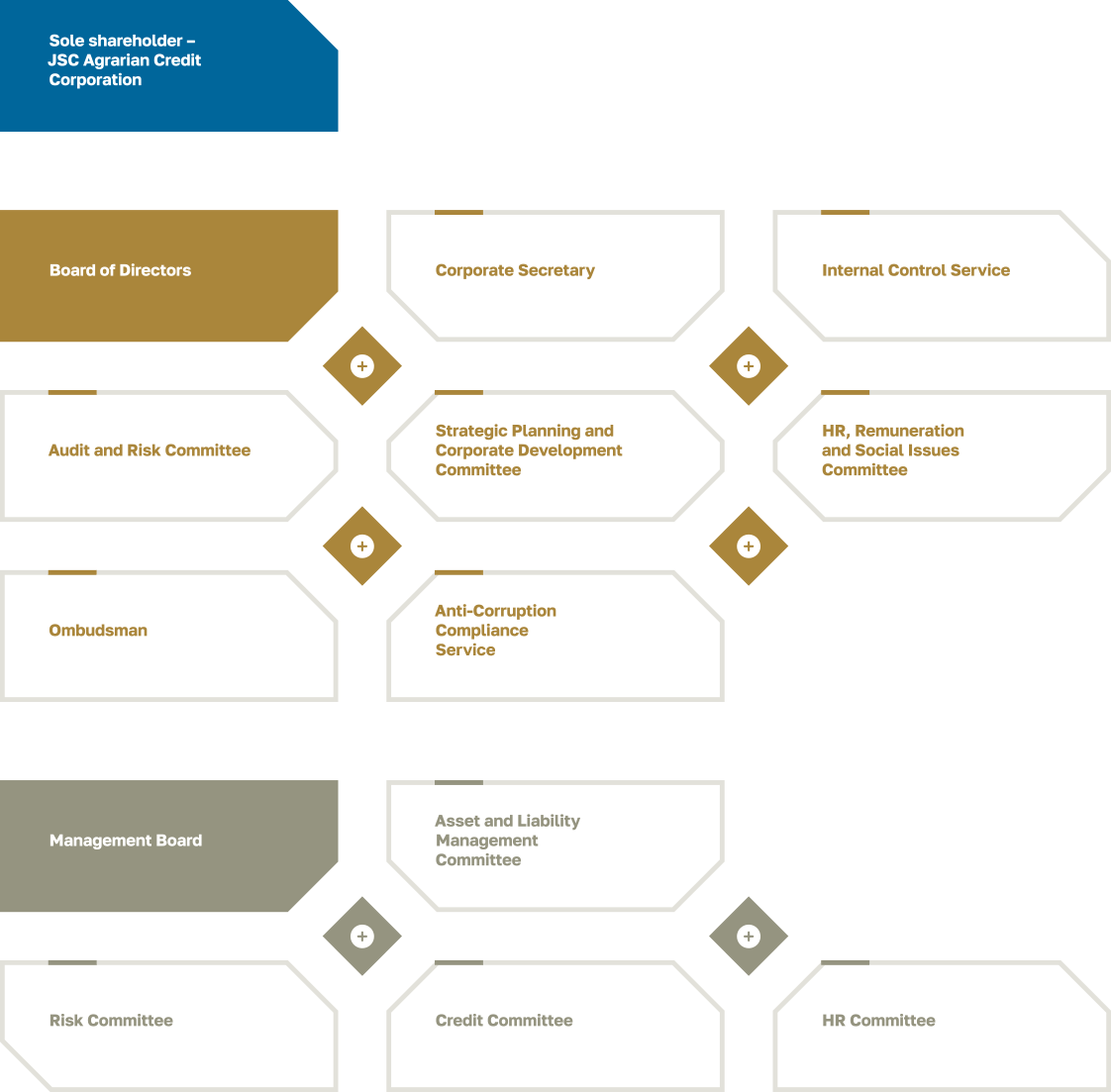

Components

of the corporate

governance system:

The Company protects the rights of the Sole Shareholder and takes effective measures in the event of violations of his/her rights

The Company ensures the accountability of the executive body of the Company to the Board of Directors and the accountability of the Board of Directors to the Sole Shareholder

The Company ensures recognition of the legal rights of the Sole Shareholder, encourages cooperation between the Company and the Sole Shareholder in matters of financial well-being and sustainability of the Company

The Company ensures timely and reliable disclosure of information on all material issues that may affect the decisions of stakeholders

The Company has formed and operates a well-established corporate governance system, developed and approved the necessary internal regulatory documents governing the activities of the Company and its bodies, and has an effective internal audit service that carries out assessments in the field of internal control, risk management and corporate governance. The management processes and procedures in the Company are structured in such a way as to ensure compliance with legislation, internal regulatory documents and create optimal conditions for making far-sighted and responsible decisions.

The highest body of KazAgroFinance is the Sole Shareholder, the management body is the Board of Directors, the executive body is the Management Board.

Organisational

structure

of management

The Board of Directors of the Company has created committees whose competence includes consideration of issues related to audit, risks, strategic planning, corporate development, personnel, remuneration and social issues. Committees under the Board have been created to prepare advisory decisions for the Management Board on individual areas of the Company’s activities, including the preparation and preliminary consideration of issues within the competence of the Management Board.

Interaction with the Sole Shareholder is carried out in accordance with the legislation of the Republic of Kazakhstan, the Charter of KazAgroFinance, which establishes the exclusive competence of the Sole Shareholder, and the Corporate Governance Code of the Company.

Dividends

The principles of the dividend policy are defined by the Regulation on Dividend Policy.

Dividends paid

| Name | Unit of measurement | 2022 (for 2021) | 2023 (for 2022) | 2024 (for 2023) |

| Net income (loss)* | thousand KZT | 17,301,745 | 20,619,374 | 18,928,175.0 |

| Dividends declared during the year | thousand KZT | 12,111,222 | 10,309,687 | 13,249,722,5 |

| Dividends paid during the year | thousand KZT | 12,111,222 | 10,309,687 | 13,249,722.5 |

| Dividend amount per share ** | KZT | 146.21 | 124.46 | 128.84 |

| Book value of a share *** | KZT | 1,774.30 | 1,889.28 | 1,800.48 |

* Net income for the year for which dividends were paid.

** Profit for the year for which dividends were paid.

*** The book value of the year for which dividends were paid.

Countering

corruption

The Company’s management and its employees adhere to the fundamental principles of openness and transparency in their work. The Company strives to ensure maximum publicity. First of all, this work is designed to ensure the fight against corruption, as well as the prevention of illegal actions by the Company’s employees.

The Company’s activities in the field of combating corruption in the reporting year.

In accordance with the requirements of the Law On Combating Corruption, the Company implements the Anti-Corruption Policy and Anti-Corruption Standards in the KazAgroFinance Joint-Stock Company approved in 2021.

The purpose of countering corruption in the Company is to eliminate the risks of corruption and is implemented by solving the following tasks:

- creating an atmosphere of intolerance towards corruption in the Company;

- developing a legal culture and sustainable anti-corruption behaviour among the Company’s employees, ensuring compliance with the principles of honesty and transparency in the performance of official duties;

- conducting a comprehensive check of the reliability of the Company’s counterparties and candidates for vacant positions upon hiring and confirming the commitment to follow the Company’s Anti-Corruption Policy;

- identifying the conditions and causes that contribute to the commission of corruption offenses, disciplinary offenses with signs of corruption, and eliminating their consequences;

- prevention, as well as timely detection of corruption, prevention of their negative consequences strengthening the Company’s interaction with other entities countering corruption.

The Anti-Corruption Compliance Service carries out its activities in order to ensure compliance by the Company and its employees with anti-corruption legislation, internal policies and standards for countering corruption.

The Anti-Corruption Compliance Service is a structural unit subordinate and accountable to the Board of Directors of the Company and has the status of independence in the implementation of its tasks and functions.